What is Bitcoin?

Bitcoin is a kind of digital currency, produced and held electronically. Bitcoins are not printed like euros or dollars, and they are not controlled by anyone. They are created by individuals utilizing some form of complicated algorithm known as Mining Bitcoin.

Bitcoins have brought in the new era of revolution in the financial sector in the form of Cryptocurrency. The most critical characteristic of Bitcoin and what makes it differ from the conventional cash is the fact that it is decentralized. No specific institution controls the network of bitcoin. This puts a lot of individuals at ease because what it means is that a large bank cannot control their cash.

Bitcoins were established when at the brink of a Financial and Economic meltdown of the US market. At the period when Lehman Brothers fell and took sleep away from investors at night, Legend Satoshi Nakamoto which was a Pseudo of a Software Developer and Inventor wrote a paper known as Bitcoin for peer to peer payment.

We have transited from old telephones to Smartphones, but the banking system was till then based on a process that was medieval aged and archaic. Individuals got upset with the financial process and were in search of a fast way out for a long time. The world got taken aback when the process of decentralized currency came into existence. It caused a storm in the market. It was hailed by investors, incumbents of banking laughed it off, individuals were taken aback.

It takes a while for individuals to accept anything that comes as a core force. Individuals stayed skeptical for a long period. They could not come to trust Bitcoin, but individuals who were tech-savvy already began to accept it and have had a crucial role to play in making Bitcoin popular.

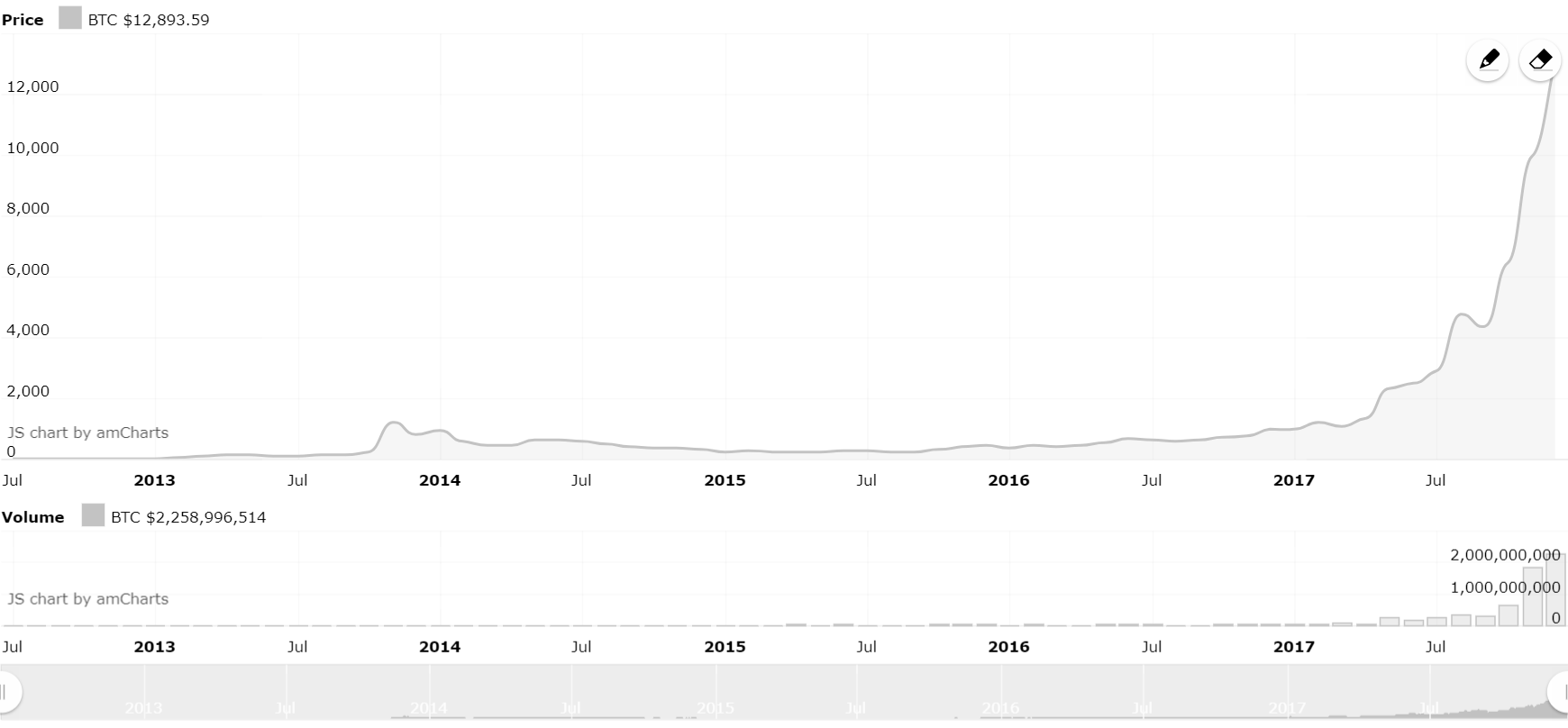

Bitcoin price increase because of its popularity, source: CryptoEN.com

Why Bitcoin is so popular?

Bitcoin was starting to attain more popularity majorly as a result of some of its characteristics which include:

- Decentralized Nature: There is no central authority responsible for the control of bitcoin. The network of bitcoin consists of each machine that processes and mines transactions and all the machines function together. In theory, this means that one central authority can not tamper with the monetary policy and be the cause of a meltdown or simply make the decision to take individual’s bitcoins from them.

- It can be set up with ease: In comparison to a traditional bank account, setting up a bitcoin account requires minutes and sometimes seconds. No fees are collected and no questions asked.

- It is Anonymous: Bitcoin users can have more than one bitcoin address, and they are not associated with addresses, names as well as other personal information for identification.

- It is Transparent: Details of every bitcoin transaction ever carried out in the network are stored in a massive version of general ledger known as the blockchain. Still, there are methods in which individuals can ensure it is less transparent on the bitcoin network by not consistently utilizing one bitcoin address constantly and not transferring a huge amount of bitcoin to just one address.

- Minimal Transfer Fees: This might be the most crucial aspect. It requires a substantial amount of funds to carry out international transactions but that is not the case for bitcoin.

- Speed: Money can be sent from any location, and it can arrive some minutes later as soon as the payment is processed by the bitcoin network.

- Wide applications: As days keep going by, more individuals keep getting educated about bitcoins. Now various governments including that of Australia, Uk, US and the UN are thinking of utilizing bitcoin and implementing it in lots of government works. Lots of leading organizations like Wipro, Accenture, HSBC, and Deloitte have either already created their lab or began in-depth research on this.

- Hedge against risk:as individuals keep dealing with challenges to keep up with the economy which Is quite Volatile and value of currency keeps degrading; individuals are beginning to look at bitcoin as a form of security against the devaluation of currencies. Majority of the experts have outlined fears in Asia and China that the possibility of yuan’s depreciation is the reason for enhanced bitcoin investment.

Bitcoin Change and ATM in Tel Aviv, Israel

Of recent, bitcoin ATMs have already been launched as an icon of broad market acceptance.