eToto Overview

Based in Limassol, Cyprus, eToro is one of the world’s leading social trading sites with about 7 Million clients. Having received numerous awards, its regulation comes from ASIC, CySEC, CFTC, FCA, and MiFID.

eToro is amongst the world’s top social arenas for trade. Social trading involves the provision of gathered information from retail Forex traders to help other online Forex traders in combination with their own knowledge and experience in trading their accounts. Traders get the opportunity to relate to each other, sharing trading strategies while using the technology of the patented eToro CopyTrader™ to copy the performance of their trading portfolio automatically.

Accounts

eToro has risen minimum required account deposits in Arabic regions to $200. For all other regions, it still $100 or increased to 40% of acquired equity (rising to $50,000).

You get a Premium membership status with a deposit of $20,000 or more, plus special benefits like Payoneer’s personal credit card, a personal manager for your account, quicker withdrawals and unobstructed access to the trading room of eToro.

Trading costs and commissions

A key factor to always take into consideration when selecting Forex brokers is trading costs. This can be separated into two groups: Spreads and Commissions, and overnight financing charges or the popular “swap rate” payments. Spreads and commissions are usually very important, meanwhile day traders don’t find the swap rates necessary at all. An impressive feature of the eToro website is the open publication of swap rates. We realized that eToro charges around 3 pips on the standard EUR/USD currency pair during the most active hours in the market. 2 pips is the normal spread for USD/JPY, meanwhile, GBP/USD is normally 4 pips. You get everything in the quoted because there are no charges on commissions. Looking at today’s market, these spreads fall slightly on the high side. Acquiring the ability to trade successfully without any spreads will make you a successful “Popular Investor”. In this case, spreads would appear considerably lower. This offer is not very much rivaled in today’s market.

eToro offers 400:1, as the maximum leverage.

No extra charges are included for copying a trader. Whether a trader is trading manually on his own or copying another trader, the spreads are unchanged.

Another feature I found impressive is the available practice account. However, this option can be missed so easily by newbie traders who fail to go through all the information in the ‘Ask a Question’ section because only this FAQ section has it listed.

eToro offers access to their social trading platform even to traders with demo accounts. Nevertheless, the display of profiles and trading activity is strictly for real traders.

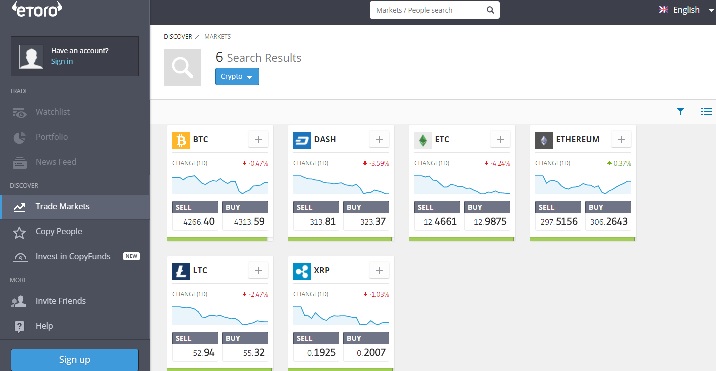

eToro platform for crypto trading

Features

The last few decades have seen remarkable social networking growth in the domain of investment. The idea of a ‘social’ arena for trade was all started by eToro years ago and they recently launched their New trading platform. The drive of eToro includes encouraging their clients to create connections with each other while trading, investing, learning and sharing knowledge to everyone on the network. The landing page always carries the gain percentage and win ratio of top-ranked traders together with some copiers. With eToro’s CopyTrader program, traders are provided the opportunity to work in groups by simply and quickly copying the trades of the best on the trading network of eToro. The Copy Trading portfolio automatically directs copied trades to the account of the trader, allowing traders with the simple and transparent task of managing of their copied trades.

eToro clients get the opportunity to build their investment portfolio and monetize it using accumulated trades. All this is thanks to The Personal Investment Program which can help clients earn impressive monthly incomes together with their profits.

eToro traders are offered benefits such as Personal Portfolios, News Feed (just like the Facebook Wall), Watchlists, trading history, risk levels and other statistics. Also, they can perform one-click trades on all screens.

They are also provided the luxury of searching with particular profile features like trade duration, location or percent of returns.

Investment options at eToro are so many including a wide range of financial market stocks, commodities like crude oil and precious metals such as gold. eToro offers Cryptocurrency trading of bitcoin, Ripple, Ethereum, Litecoin, Dash and bitcoin cash. The example is set by the methods of top performing investors for other traders to copy. Added to the numerous trading products offered by eToro, US, Italian and Spanish stocks, together with ETFs and Chinese and Russian ADRs are now available.

In January 2014, eToro added the bitcoin to its trading choices. However, the bitcoin is listed as a stock on eToro’s platform, differing from the majority of other bitcoin brokers who regard bitcoin as a currency. The bitcoin is traded on the platform on a CFD basis, implying that traders purchase and sell financial derivatives tracking the price of the BTC without getting to own the underlying asset.

eToro recently redesigned their old OpenBook and WebTrader platforms to fit all devices, giving birth to their all-new responsive and fully optimized HTML5 web application which runs on virtually every mobile device.

Their website which can be reached using mobile devices has detailed information about their mobile app. However, updates including all Copytrader features are not available yet. Therefore, it is preferable to access the website on your mobile device instead of using the app for now.

Deposits/ Withdrawals

Bank transfer, PayPal, Neteller, credit cards, Skrill, MoneyBookers, and WebMoney are the accepted media for making deposits into an eToro account.

To make a withdrawal, you, first of all, enter the ‘cashiers’ section, and then click on withdrawal, before going on to fill out the provided withdrawal form (electronic).

Promotions

eToro offers no deposit bonuses thanks to regulatory restrictions. Nevertheless, traders can profit from additional promotions like the 2% management fee and 100% spread rebate which comes with registration as a Popular Investor. We highly recommend regular traders to consider signing up for this program.

Education

The education center of eToro education provides many tools like training courses, webinars and several videos that enhance successful trading. They suggest suitable trading options and guides from the basics of trade, deposits, and withdrawals from existing accounts.

Traders are also offered the option of joining a live webinar where the online trading experts of eToro provide assistance on how to navigate through the eToro platform. Here, traders are open to trading tips from top financial field experts.

At their own speed, traders get to master financial trading with the help of the exclusive financial trading eCourses of eToro. These eCourses are interactive and designed to serve new as well as experienced traders.

Current happenings in the Forex world are displayed on the news screen found on the WebTrader platform. eToro’s market analysts are always on hand with live updates on the news items.

There is also an eToro blog in several languages.

Customer Support

Traders can reach out to eToro customer support representatives via live chat or phone 24/5. Support by phone is toll free for UK, New Zealand and Cyprus local numbers. Questions are also quickly responded through email.

The offices of etoro are spread throughout the world, giving them the ability to easily handle a customer base speaking so many different languages.

Conclusion

For people in search of a platform that optimizes interaction between currency traders, eToro is definitely one of the best options. It works perfectly for anyone looking to study how others perform their investments. Added to the very welcoming account choices for different locations, the OpenBook presents an amazing testing arena for beginners. However, experienced traders looking for tiny spreads would likely not be impressed by eToro’s two pip minimum.